PHH Mortgage, or

How The Dragon Feeds On A company

In the case of PHH Mortgage, once the Money Kings determined the potential of the collapsing real estate market, or perhaps even orchestrated by them, these leading investment banks put PHH into a no-win situation. This story was released today in the New York Times under the heading of "Deal to Buy Mortgage Company Collapses."

"In another sign that troubles within the mortgage industry will continue into 2008, one of the largest originators of residential home loans announced Tuesday that it is scrapping a planned $1.8 billion sale, because banks had failed to agree to finance the transaction."Okay, that sounds simple enough on the surface. The banks changed their minds after the deal was announced because of the deterioration of the real estate market. But the mind of the Dragon does not work in such a straight-forward manner. The next paragraph provides clues:

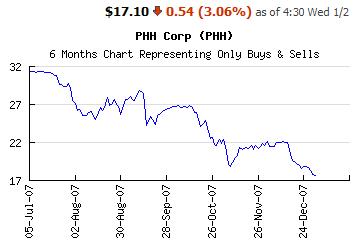

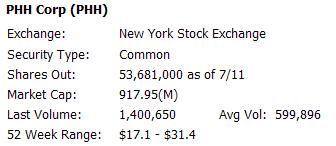

"PHH, a New Jersey-based mortgage and vehicle leasing company, announced in March [2007] that it was selling itself for $1.8 billion to General Electric and the Blackstone Group, a large private investment company. But as the mortgage industry continued to deteriorate, the banks financing the transaction — JPMorgan and Lehman Brothers — slashed the deal’s loans by as much as $750 million in September."My point is that by saying that they were going to buy PHH, they identified the target, and away went the short selling. By stalling the transaction, they knew the stock would collapse along with the rest of the real estate market. The above chart on the left shows the stock fairly stable for a few days after July 5th, and the chart on the left shows 53,681,000 shares outstanding, so PHH's value then was $1,690,951,500. Today, when they announced the deal was dead, the stock was $17.10, or $917,945,100, or $773,006,400 less than earlier this year. So the story continues:

"PHH said Tuesday it was terminating the sale because Blackstone, which was to acquire the mortgage business, had failed to find alternative financing."How convenient! Down at the bottom of the story, it says:

"Under the terms of the deal, Blackstone is liable for a $50 million termination fee, payable to PHH. General Electric is not required to pay a termination fee."So Blackstone pays a $50 million termination fee for failing to close the transaction. In the meantime, the value of PHH Mortgage Corporation declined by $773 million. If some of the major holders (listed below) of General Electric, Blackstone, JPMorgan and Lehman went short, $50 million would be a small price to pay for the profits they may have already taken, or even may be continuing to take. You will notice below that none of the major holders of PHH have any major holdings in the four other players, with the exception of Barclays. But none of the other major holders of investment brokers or banks had a major stake in PHH. However, please note many of the same Top 10 Major Holders among each of the four players, such as AXA, Barclays, State Street, and so on. Interesting, indeed.

Obviously, this is strictly my opinion. I cannot prove anything. But I still think the situation stinks. On top of that, the same technique was used in 2007 on H&R Block, too. At the bottom of the story is:

"Last month, H&R Block, the tax preparation company, announced it was closing its mortgage lending arm after the private equity firm Cerberus Capital Management walked away from a deal to buy it for $300 million."I wouldn't make an issue of such things as this, except that I cannot help but think of the pension funds of teachers, policemen, firemen, city workers and many others who are counting on those investments. They have invested some of their earnings these last 30 or 40 years, expecting something to be there when they need it in order to survive. Things are bad enough with the devaluation of our dollar without being swindled out of their pensions, too.

On the cover of the old 1889 book, on which this site is based, is "The Tendency toward Combination and Monopoly is one of the darkest clouds on our Industrial and Social Horizon." Guess some things just don't change.

|

|

|

|

|

One last thing: If you found this information valuable, please support this site with a donation or a gift to a valued friend,

so that this information stays available for those who will pass this way after you. Thanks!

© 2007 by Edward Ulysses Cate

Help Support This Site

Commentary Index

Home