MBIA AMBAC What's Going On?

Here's the latest headlines:

Insurer

Of Bonds Loses Top Rating - Washington Post

Bond

Insurers’ Distress Rattles Wall Street - New York Times

Ambac Downgraded, Cities Seen at Risk - AP

MBIA: Priced for Catastrophe - Barron's Online

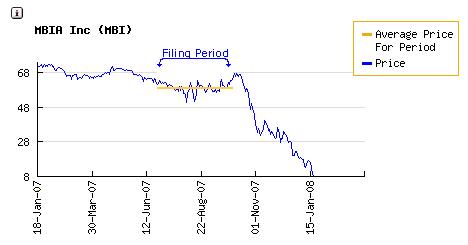

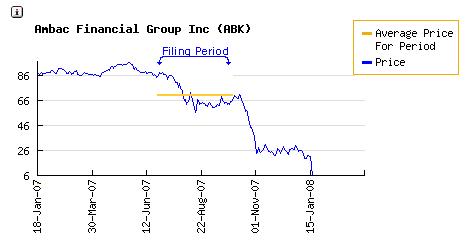

Here's a look at the charts.

MBIA closed at $8.55 as of 4:30 Fri 1/18, down 85.52% since 9/30/07.

AMBAC closed at $6.20 as of 4:30 Fri 1/18, down 91.09% since 9/30/07.

Now, click on each image and note who SOLD, and who BOUGHT.

NOTE: The cut-off at 500,000 shares was simply arbitrary.

This lists changes in shares of MBIA between Jun 30 and Sep 30, 2007. [XHTML file]

This lists changes in shares of AMBAC between Jun 30 and Sep 30, 2007. [XHTML file]

The tables below shows who were the TOP 10 Major Holders as of 9/30/07.

Be sure to check out to see who's in the TOP 10 at the rating agencies, too.

Did somebody simply pull the plug? It's your call.

(Naming names can result in lawsuits that I don't need.)

Sometimes The Dragon Wins

|

Vanguard manages two funds that control 4.01%.

Fidelity manages two funds that control 3.01%.

Cramer Rosenthal McGlynn manages a fund that controls 1.56%.

Therefore, the TOP 10 control over 71.36% of MBIA.

|

Goldman Sachs manages a fund that controls 1.98%.

Davis manages a fund that controls 1.96%.

Putnam manages a fund that controls 1.25%.

Waddell & Reed manages a fund that controls 1.05%.

Therefore, the TOP 10 control 65.02%, and

Barclays/Associates control 26.33% of AMBAC.

Rating Agencies

|

NOTE: McGraw-Hill owns these companies and these:

- BusinessWeek Magazine

- Standard & Poors Ratings Service

- Standard & Poors Financial Information

|

© 2008 by Edward Ulysses Cate

Help Support This Site

Commentary Index

Home