|

|

|

|

|

|

|

| Posted on Wed, Jul. 05, 2006 | |||

|

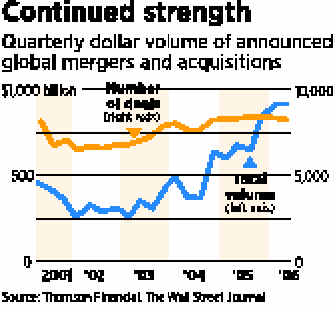

Frantic pace of mergers continues It was the third-most active quarter since 1985, with more than $916 billion of announced deals worldwide. The Wall Street Journal “There will be deals that destroy value. There always are. And people have to be careful.” George Bilicic, managing director at Lazard Ltd.

A strong first quarter for mergers continued in the second quarter, as deals rolled in from seemingly every sector: banks, stock exchanges, oil companies, real estate firms and consumer products companies. It was one of history’s largest and most diverse corporate-buying sprees, with nearly $1 trillion in deals throughout the world. The frenetic deal-making produced the third-most active quarter since Thomson Financial began keeping track in 1985. It amounted to more than $916 billion of announced transactions, according to Thomson, up about 35 percent from about $676 billion a year earlier. Worldwide deal volume in the last three months trailed only the inflated totals of late 1999 and 2000, during the stock market bubble. It beat the record set in this year’s first quarter of $914 billion. The numbers in the United States also were impressive, with total volume of $369 billion, up 25 percent from the year-earlier total of $294 billion. In the first half of the year, global deal making moved at a clip of $1.83 trillion, up 43 percent from last year and on pace to make 2006 the most active year ever, based on noninflation-adjusted dollars. When controlling for inflation, 2006 is on pace to be the third-most active year after 1999 and 2000. “Even factoring in the tech bubble, our (mergers and acquisitions) backlog is the strongest in history,” said Boon Sim, U.S. merger head for Credit Suisse Group. “With the Fed’s recent remarks on interest rates,” he said, referring to indications from the Federal Reserve that interest rates won’t go much higher, “we can expect things to remain pretty healthy for the near future.” For deal makers and deal junkies, the quarter brought a bounty of notable milestones: Thirteen transactions valued at more than $10 billion, headline-grabbing cross-border transactions such as the NYSE Group Inc.’s $10.2 billion bid for Euronext NV of Amsterdam, Netherlands, and a battle over Toronto mining companies Inco Ltd. and Falconbridge Ltd. that started when Inco announced plans to acquire Falconbridge last October. A competing bid for Falconbridge and two bids for Inco were announced in the latest quarter. Deal making continued through the last day of the quarter, with Blackstone Group’s $4.3 billion offer for the Travelport travel-services unit of Cendant Corp. And late Friday, Michaels Stores Inc. announced that it accepted a more than $6 billion takeover bid from a private-equity group including Bain Capital and Blackstone Group. That deal came too late to be included in Thomson Financial’s calculations for the quarter. Like the first quarter, the center of the deal making in the latest period wasn’t the United States but Europe. A series of cross-border combinations continued the first quarter’s pattern. Cross-border mergers and acquisitions surged to about 40 percent of total deal volume, or $685 billion-plus of transactions year-to-date, according to data from Citigroup. In just the first five months of this year, the volume of international deals already was greater than full-year totals for 2001 through 2004. The weakening and volatile stock market failed to deter the deal making. Steven Baronoff, Merrill Lynch’s global-mergers chief points to a few fundamental changes supporting the wave of acquisitions. Hedge funds are forcing companies to put themselves on the block by agitating for corporate changes that would increase stock prices. From there, private-equity funds — flush with billions of dollars to invest — are scooping up the prey. Private-equity funds are proving to be the ballast of the overall market, willing to inject capital into all kinds of deals, including the pending $13.55 billion acquisition of Houston oil-pipeline operator Kinder Morgan Inc., announced in late May. There, a group of private-equity investors, including Goldman Sachs Capital Partners, the Carlyle Group and its Riverstone Holdings affiliate, and American International Group Inc., along with Kinder Morgan chief executive and founder Richard Kinder assembled cash and debt to propose the second-largest private-equity transaction ever. Acquisitions involving private-equity firms surged 51 percent in the first half to about $335 billion, according to data provider Dealogic, from $222 billion in the first six months of 2005. Private-equity transactions represent about 18 percent of all merger-and-acquisition activity worldwide, in line with a trend that has been building since the end of 2003. “This market is fundamentally different than in prior expansion periods,” said Louis Friedman, global chairman of mergers and acquisitions at Bear Stearns Cos. “These huge pools of private capital are consistently able to compete with strategic, corporate buyers.” That was clear when Cerberus Capital Management announced in April a $7.85 billion transaction to purchase a controlling stake in General Motors Corp.’s financing arm, General Motors Acceptance Corp. In this complex deal, large banks steered clear, letting private investors take on the risk of the transaction. There are plenty of reasons to be cautious. Rising interest rates, greater competition for deals and some more adventurous combinations — such as Phoenix mining company Phelps Dodge Corp.’s audacious $35 billion, three-way deal involving both Inco and Falconbridge — show that the market is getting frothier. “There is one thing you can say for sure,” said George Bilicic, a managing director at Lazard Ltd. “There will be deals that destroy value. There always are. And people have to be careful.” | |||