Barrick-Teck Cominco-Novagold

What The Hell Is Going On?

Before we get into this discussion, here's some guiding words from 1889:

"The Money Power Is Devouring Our Gold and Silver MinesIn the case of Novagold, once the Money Kings understood the real potential of Novagold's holdings, Barrick quickly went from being a smilin' father figure to being a rapist. This has all been wisely documented over a year ago by GATA, which you will find here. [You should read that before continuing.] Mineweb picked up Barrick's denials and printed it, but it's long gone from their site. I saved a copy here.

As a rule, persons having gold or silver mines to develop always go to the Money Kings or their agents for the capital to develop them. And the Money Kings never put any money into a mine without having a majority of the stock given them, so as to secure to them its absolute control. They must have the lion's share in any enterprise before they will invest in it. They usually put in one of the original stockholders as their agent and manager; and generally the mine is so managed as to freeze out the other stockholders.A shaft is sunk down upon the "lead;" if it proves to be rich, only the poorer levels nearer the surface are worked, till the outside stockholders become discouraged and sell out their stock cheap: then the mine is worked efficiently. But if, on the other hand, the mine proves to be a pocket, like the Emma Mine in Utah, [today we would think of BRE-X] it is puffed in the papers until outsiders have bought the stock; then the true state of things is revealed. Having full control of the mine, they are able, with their agent, to manipulate it as they please; and finally they thus get control of all valuable mines."

Today, Mineweb has an article saying the "Citigroup calls for NovaGold sale after Galore Creek ‘mining disaster.’"

Citigroup called for the sale of NovaGold Resources after what they call the ‘making of a mining disaster’ in the ‘capex blow-out’ of Galore Creek, and the embarrassment of JV partner Teck Cominco.

While documenting the common ownership of these companies last year, I did have a bad feeling when Novagold selected Citigroup as its financial advisor for Galore Creek, which took place right after fighting off a buyout with Barrick last year. Novagold documented that here. I did NOT know how bad that could be.

As we're seeing today, it turns out that this set up Novagold for EXACTLY the same strategy used by former SEC Breeden to force Applebee's to sell out to IHOP. That's documented here. Analysts from two firms that downgraded Applebee's shares before the sale were the SAME two firms listed as Major Holders of IHOP. Here's a short quote from that commentary:

For example, the Kansas City Star reported that "Jeff Omohundro at Wachovia Capital Markets LLC posted an underperform rating on the Overland Park-based restaurant chain's shares Monday," in KCS Business Section on 10/23/07, Page D30. The same article also said "His comments echo those of a month ago from Michael Smith at Oppenheimer & Co. Inc. Smith had suggested selling Applebee's shares because a private equity owner and some insiders oppose it."Is Citigroup using a similar tactic? Chinese walls, yeah right. Using the same logic, Citigroup is downgrading Novagold, but has the same Major Holders as Barrick and Teck Cominco. In fact, even the company AMEC is a LSE company out of Britain, home of Barclays. I can't find out, but I would not be surprised if Barclays & Associates were Major Holders of AMEC, too. Resource Investor has commented here:Okay, this is where it gets interesting. Take a look at IHOP's major holders here. Isn't it simply amazing that no referee [SEC] called foul. Both Wachovia and Oppenheimer are Major Holders of IHOP, the BUYER! Oops, forgot that we're talking about the former head of the SEC. Sorry.

“It appears that according to AMEC, Hatch grossly under-estimated the amount of man hours necessary to complete the in-valley earth works - tailings dam and diversion structures."Knowing that these firms are interconnected, I can't help but think AMEC has some explaining to do, rather than Hatch.

Plantations all, with insiders holding 1% or less, the Money Kings now want to acquire Novagold cheaply and screw the other shareholders. I guess things just don't change much in a few hundred years.

Here are the Major Holders in Citigroup:

|

Now take a look at the Major Holders of Barrick:

|

Growth Fund of American, which manages 3.04%.

New Perspective Fund, which manages 2.58%.

Investment Company of America, which manages 2.31%.

Capital World Growth Fund, which manages 2.17%.

American Funds Insurance Fund, which manages 1.21%.

EuroPacific Growth Fund, which manages 1.05%.

Therefore, the Capital Group alone manages 28.97%, and the Top 10 actually controls 51.83% of Barrick Gold.

Now take a look at the Major Holders of Teck Cominco. You'll see that insiders hold only 1% of TCK stock. The Money Kings already own most of it.

|

Therefore, the TOP 10 control 31.51% of Teck Cominco.

Significant Transactions Recorded With SEC

| New 5% | 2007-09-10 | 13.0% | BARCLAYS GLOBAL INVESTORS | FORDING CANADIAN COAL TRUST | New 5% | 2007-09-27 | 20.0% | TECK COMINCO LTD ($47.56) | FORDING CANADIAN COAL TRUST |

And here's the Major Holders of Novagold. Notice the increases in stock owned by the major holders just this year? And by whom? These are definitely NOT stupid people, just sociopaths. They want it all. Notice that the insiders here have 13%, compared to TCK at 1%. Big difference.

|

Royce & Associates manages two funds that control 1.81%.

Nuveen/Tradewinds manage a fund that control 0.99%.

Blackrock manages a fund that controls 0.66%.

Therefore, the TOP 10 actually control 52.16%, and

Barclays/Associates control 42.90% of Novagold.

Significant Transactions Recorded With SEC

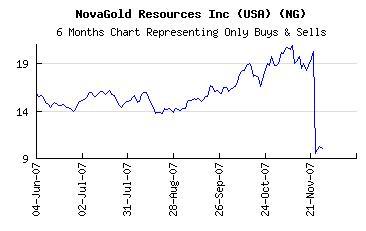

| New 5% | 2007-07-09 | 19.0% | TRADEWINDS NWQ GLOBAL INVESTOR ($15.58) | Amended | 2007-04-20 | 0.0% | BARRICK GOLD CORP ($16.18) | Amended | 2007-04-09 | 14.8% | BARRICK GOLD CORP ($16.98) | Amended | 2007-02-13 | 9.0% | NEUBERGER BERMAN INC ($16.66) | Doc | 2007-01-09 | -98.0% | SPROTT ASSET MANAGEMENT INC ($15.97) | New 5% | 2006-12-01 | 14.4% | BARRICK GOLD CORP ($16.13) |

© 2007 by Edward Ulysses Cate

Help Support This Site

Commentary Index

Home